Finance

Finance

Overview

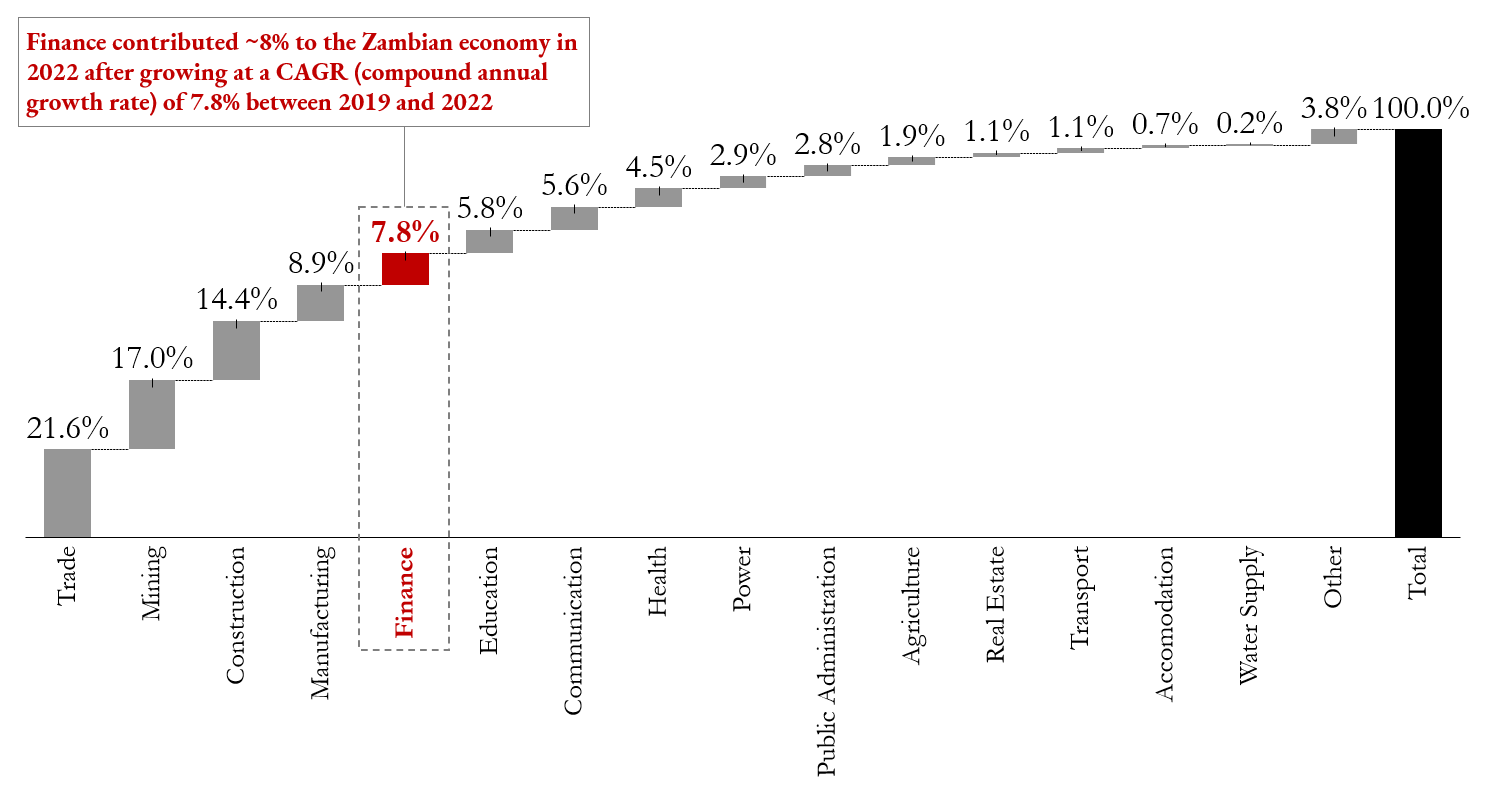

Zambia's financial sector is relatively developed with various financial institutions such as commercial banks, microfinance institutions, pension funds, insurance, and other non-banking financial institutions. The sector contributed ~8% to the gross domestic product in 2022 and is one of the fastest growing sectors, experiencing a growth rate of 8% between 2019 and 2022. At the end of 2022, there were 19 commercial banks with assets valued at around ZMW 150 billion, 149 registered non-banking financial institutions, 34 insurance companies, and several pensions fund administrators with over 1 million members enrolled in various pension schemes.

The banking sub-sector is expected to benefit from a stronger economic growth outlook in 2023 which will support a recovery in credit growth. The total banking asset base will grow from investments in government bonds and treasury bills. However, the Bank of Zambia, in its contractionary monetary policy, increased the statutory reserve ratios from 9% to 11.5% and the monetary policy rate from 9.0% to 9.25% effective February 13 2023, which will limit the amount of loans given to consumers and businesses. In addition to monetary policy uncertainty, banks have also seen a significant rise in non-performing loans amidst a relatively weak macroeconomic backdrop arising from Zambia's overdependency on copper and agriculture, leading to struggles in meeting the central bank’s 10% non-performing loan target ratio.

The insurance sub-sector is expected to witness a growth in total gross premiums written at an average annual rate of 13.1% in the medium-term, increasing to ZMW 9.39 Bn in 2026 from ZMW 5.87 Bn in 2022. However, Zambia’s insurance sector pales in comparison to those of regional peers, due to vulnerability to the fortunes of copper prices, low insurance market penetration, lack of consumer awareness and limited data and statistics on insurance activities, which hinder growth and reduce demand for insurance services.

In terms of capital markets, Zambia’s largest capital market is the Lusaka Securities Exchange (LuSE), with 25 listings (November 2022) and a market capitalization of ZMW 73.97 Bn. The market has experienced a rise in total market capitalization following a recession induced by the coronavirus pandemic. Challenges faced by the capital market include few listings leading to low trading volumes (ZMW 1.29 Bn in 2018) and low market turnover, at around 5% in 2018.

In recognition of the strategic importance of the finance sector to the Zambian economy, the advisory team at Red Black Ventures offers comprehensive strategies that help financial institutions boost resilience in their portfolio, amidst the market's fragile fiscal policy and other challenges. By addressing challenges within the finance sector and leveraging its strengths, companies can transform the sector and increase support to the country's long term growth outlook.

At Red Black Ventures, we believe that unlocking the full value of the finance sector requires a deeper understanding of its unique challenges and opportunities. We keep a close eye on market trends, gather data, and work with businesses to develop effective strategies and ideas that help them succeed in the sector.

Finance by the numbers

Contribution to GDP by Sector, Zambia (%)