Unlocking Zambia’s Agricultural growth potential

Featured Image

March 07. 2023

The future of Zambia’s food security and poverty levels hinges on the success of its agricultural sector. With rapid population growth, urbanization, and climate change posing grave threats to the nation’s well-being, the need to unlock the full potential of Zambia’s agricultural system has never been more critical.

At Red Black Ventures, we believe that a thriving agricultural sector can drastically reduce poverty levels in Zambia. Startling statistics reveal that nearly 66% of Zambia’s population lives on less than $2 per day, with many struggling to make ends meet (Habitat for humanity, 2022). Agriculture remains the primary source of income for most households, employing about 70% of the total labour force (Pmrc, 2021). Research shows that by increasing productivity and investment in the sector, Zambia could potentially cut poverty levels by 50% – in line with the Comprehensive African Agriculture Development Program (CAADP) – through employment creation and increased household incomes (CAADP, 2023).

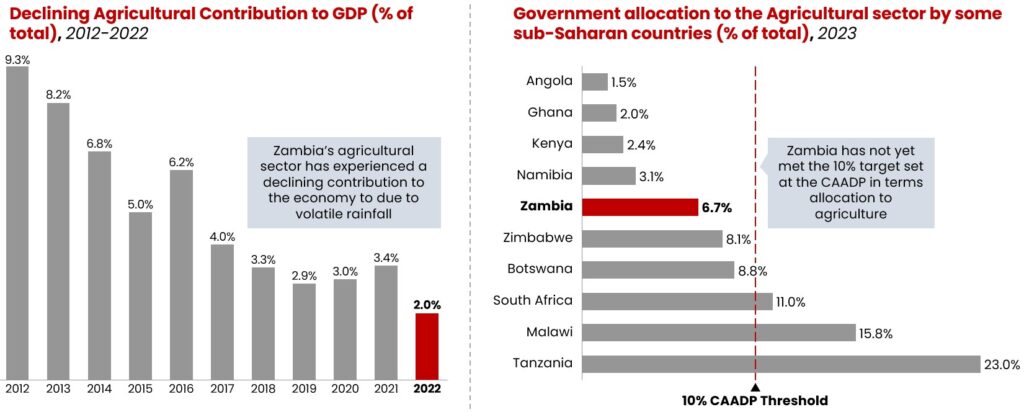

Despite being one of Africa’s fastest-growing economies, Zambia’s agricultural sector has failed to keep up with the pace. The sector contributed a mere 2% to the economy in 2022, and in nominal terms, the sector’s contribution has declined at an average rate of 2% per year between 2019 and 2022. The sector is also underinvested, with the government allocating only 6.7% of its budget to agriculture in 2023, falling behind comparable Southern African countries and failing to meet the agreed 10% threshold of the CAADP (Exhibit 1).

Exhibit 1: Agriculture has experienced declining contributions to the economy and is largely under-invested

Sources: RBV’s Analysis, Zambian National Budget, CAADP, 2023 national budgets

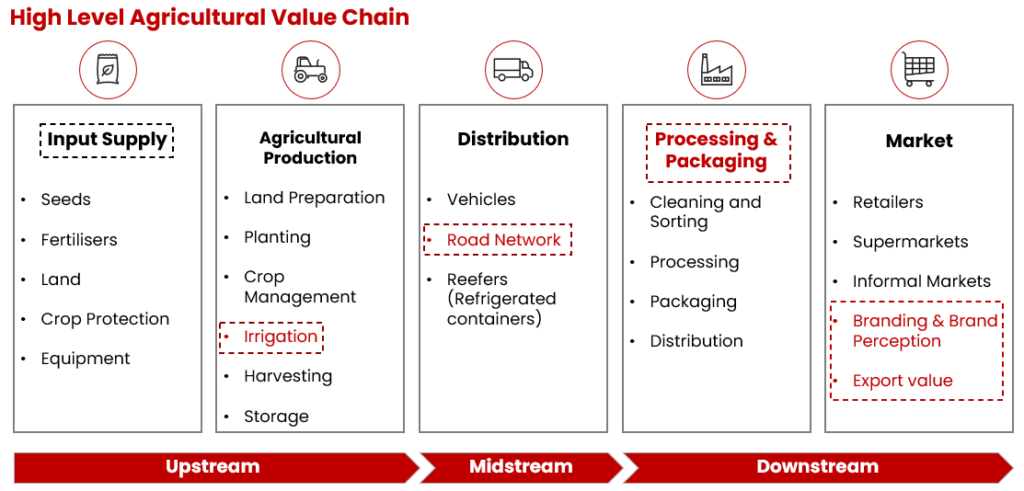

To unlock the growth potential of Zambia’s agricultural sector, Red Black Ventures identified five (5) critical areas in the agricultural value chain to focus on: input supply, irrigation, value addition, transportation, and markets (Exhibit 2). While we understand clearly that input supply is one of the sector’s biggest pain point, we have chosen to speak on extracting value beyond addressing the input supply challenges, which is a frequently discussed topic. This article aims to suggest solutions to prevalent challenges in the aforementioned areas which are hindering the growth of Zambia’s agricultural sector.

Exhibit 2: Unlocking the growth potential of Zambia’s agricultural sector requires prioritization of the critical areas of the value chain, in addition to inputs costs

Sources: RBV’s analysis

1. Irrigation remains a significant bottleneck to crop yield and output

Zambia’s agricultural sector is facing significant challenges due to the unpredictability of rainfall patterns. Currently, less than 7% of the country’s 4 million hectares of arable land is equipped with irrigation, a stark contrast to the 38% seen in comparable countries (Matchaya et al., 2022). Despite investments in fertilizer and seed distribution programs, crop yields are still below benchmarks. The issue is not necessarily a lack of water, but the instability of rainfall. According to Matchaya et al.’s (2022) study, there is an up to 87% chance of a dry spell during certain seasons, resulting in a significant reduction in crop yields. Immediate investment in appropriate irrigation technologies and accurate data on rainfall patterns is necessary to increase productivity and mitigate the risks of climate change.

One solution is for the government and other stakeholders to invest in irrigation technologies specifically designed for smallholder farmers. Solar-powered irrigation systems could be highly beneficial as they overcome the infrastructure and energy constraints that rural communities face. Tanzania’s Smallholder Irrigation Revitalization Program has successfully developed small-scale irrigation schemes, supporting over 6,000 hectares of irrigated land and raising the incomes of more than 30,000 farmers (IFAD, 2016). Implementing similar programs in Zambia could significantly improve crop yields and the livelihoods of small-scale farmers.

Moreover, accurate and timely data on rainfall patterns are crucial for farmers to make informed decisions on planting, irrigating, and harvesting crops. Weather stations, remote sensing technologies, and crowd-sourced data collection can provide this information. Increased investment in such technologies can mitigate the risk of erratic rainfall patterns, increase productivity, and ultimately improve the livelihoods of farmers.

2. Value addition to agricultural produce will create significant economic benefits

Farmers who focus solely on crop or livestock production may struggle to make a significant profit due to the low value of their products. However, there is potential for agribusiness players to increase their income and provide consumers with more diverse food options by transforming raw agricultural produce into high-value products.

However, to unlock the full economic potential of agriculture, it is not enough to simply scale up productivity. Red Black Ventures conducted an extensive analysis of the different stages in the agricultural value chain, specifically examining the value addition process for a 25-kilogram bag of mealie meal from the farmer to the final consumer. The study found that the processing stage is the most profitable, with an estimated margin of 20-30%, and accounts for nearly 30% of the total value of the final product (Exhibit 3).

Additional analysis revealed that although maize farmers generate the highest revenue, their profit margins are frequently low or even negative, as high input costs often offset their earnings.

Exhibit 3: Zambia can increase the value of maize by focussing on the processing stage of the value chain

Sources: RBV’s analysis, Food Reserve Agency, Food and Agricultural Organisation

To realize the growth potential of the agricultural sector, Zambia must prioritize food processing for raw crops. The government should promote the development of appropriate agro-processing industries to maximize processing capacity, resulting in the creation of value for agricultural products.

Vertical agricultural integration is another long-term initiative that Zambia should employ to increase the value generated by the agricultural sector and promote sustainable economic growth. This approach involves training farmers to handle both production and some processing activities within the agricultural value chain. By doing so, farmers can capture more value from their produce and contribute to the development of a more diverse and competitive agro-processing industry.

There is also a need to encourage and prioritize agribusinesses that offer immediate value addition through commodity-based industrialization that can help lift many rural dwellers out of poverty while creating jobs in the economy. By exploiting the many agricultural products produced locally, these businesses can generate added value through processing and manufacturing activities, leading to higher incomes and greater economic diversification.

3. Zambia’s poor road network hinders the growth of the agricultural sector

A well-developed road network is essential for the success of agriculture as it enables efficient transportation of produce to markets. This reduces transportation costs, increases the competitiveness of agricultural products, and helps in preserving perishable products.

Notwithstanding the importance of the transport network to the development of the agricultural sector and the overall economy, many of the roads, especially in rural areas, are in poor condition, making it difficult and expensive for farmers to transport their produce to the markets. This is particularly true during the rainy season when many roads become impassable.

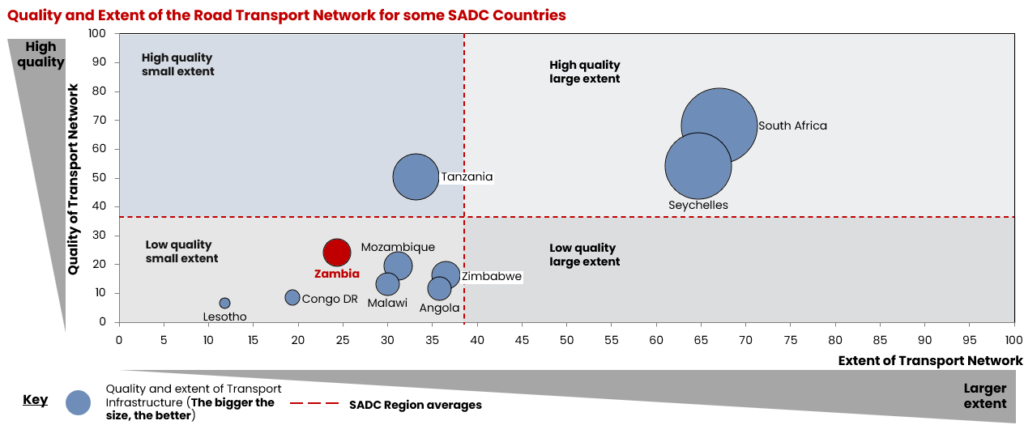

RBV researched on the quality and extent of road networks in most SADC member countries, using two key metrics on a scale of 1 to 100, to determine Zambia’s position relative to its neighbours. The data indicates that Zambia’s road network falls significantly behind that of its regional peers in terms of both quality and extent, highlighting a potential need for increased investment in transport infrastructure (Exhibit 4).

Exhibit 4: Zambia’s low quality and extent of transport infrastructure negatively affects access to markets by farmers

Sources: RBV’s Analysis, Fitch, World Bank

Zambia’s inadequate road network can be attributed in part to a lack of investment in transport infrastructure. Government spending on transport infrastructure has decreased by over 50% in nominal terms between 2020 and 2023, with a drop in the percentage of total spending from 10% to 3% in the same period.

The poor road network has had a direct impact on small-scale farmers in several ways, including limited market access, difficulty in accessing agricultural inputs, and increased losses for perishable products.

In addition to the impact on smallholder farmers, a deficient road network has had a negative effect on Zambia’s export potential, increasing transportation costs, causing delays and interruptions in the transportation of goods, and reducing product competitiveness in international markets. The situation is particularly worse for perishable products whose quality is compromised due to poor road networks and a lack of reefers (refrigerated transport containers).

From the foregoing discussion, it is apparent that addressing these challenges is critical in enhancing the livelihoods of farmers and fostering economic growth in Zambia. Increasing investment in road infrastructure is crucial to unlocking the export potential of Zambia’s agricultural products.

While we recognize that improving road infrastructure is a complex and long-term process that requires a variety of approaches, the first essential step is for stakeholders to provide funding for the construction, maintenance, and repair of strategic roads. This funding can be secured through government budgets, more public-private partnerships, or international development assistance.

Start-up companies in the private sector such as small-scale traders can play a significant role in assisting small-scale farmers in inaccessible areas. They can collaborate with other stakeholders in the value chain, such as farmers’ cooperatives and processors.

4. Zambia’s domestic and regional markets have a huge potential to stimulate agricultural growth

Markets make the final phase of the agricultural value chain as they provide an ultimate link between the produce and the consumer. They play an important role in stimulating production and consumption while accelerating economic development. Markets also foster competition among stakeholders, encouraging the adoption of new technologies and strategies that ultimately improve productivity, efficiency, and sustainability.

Zambia’s domestic and regional markets are well-positioned to promote the growth of the agricultural sector. Its domestic retail market is maturing and contains many large, medium, and small grocery stores across the country. Regional markets, on the other hand, present many export opportunities for Zambia’s agricultural products as food demand in Sub-Saharan Africa is increasing.

However, for Zambia to tap into these market opportunities effectively both locally and regionally, RBV highlights two important actions that must be taken.

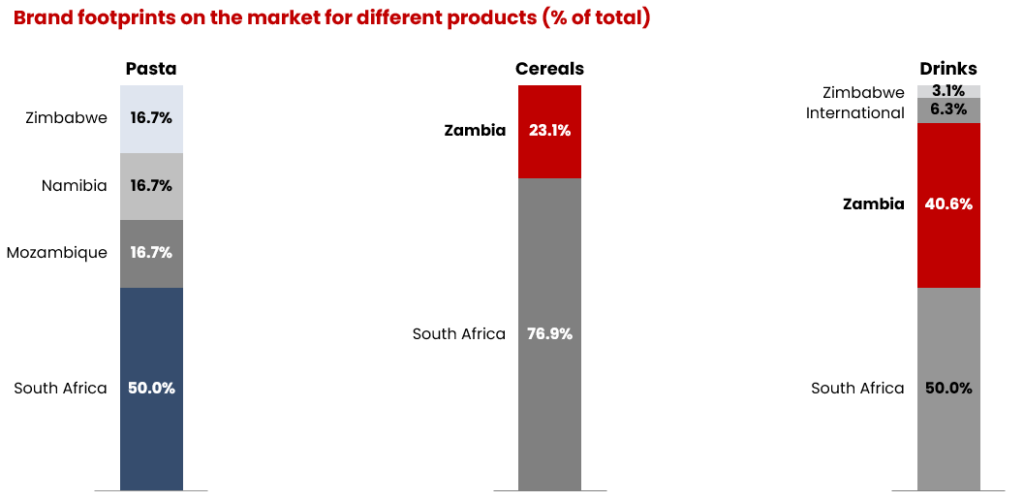

Promoting local brands will help to capture domestic markets

For Zambian products to thrive in domestic markets, there is a need to promote locally processed agricultural products, to compete effectively with imported ones. To evaluate the footprint of Zambian brands on local markets, RBV assessed available brands in a typical market. The study revealed that Zambia’s local markets are heavily dominated by foreign brands, mostly South African-based (Exhibit 5). This suggests that either there is a lower demand for local products due to a lack of brand awareness among consumers, or the quality of locally processed products does not match that of foreign brands.

Exhibit 5: Foreign brands heavily dominate Zambia’s local market for most products

Source: RBV’s analysis

To improve brand awareness among Zambian consumers, food processing businesses should take full advantage of the benefits that stem from integrating brand awareness activities with electronic media platforms such as social media in marketing local products. This will increase demand for locally processed food products, thus helping the country in tapping into local market opportunities and realize value for the agricultural sector.

Additionally, businesses should actively involve their customers in the product development process by soliciting feedback and ideas. While enhancing product quality, this approach can also help companies to better understand the needs and preferences of their target market, and ultimately create products that better meet their customers’ expectations.

More export of processed products to increase revenue prospects

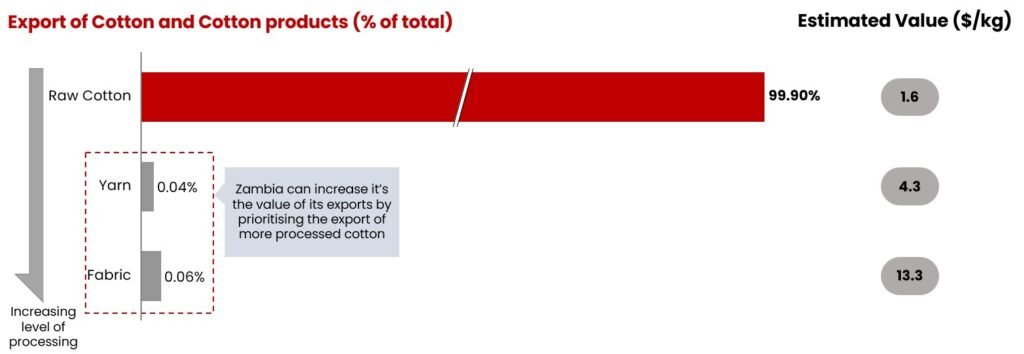

Zambia has high yields in crops such as maize, soybeans, sorghum, and cotton, resulting in exportable surpluses. However, these products are typically exported without processing (Exhibit 6), reducing their value on the market. Hence the need to enhance industrial processing capabilities for agricultural products to increase revenue collection, as raw materials are readily available.

Exhibit 6: Zambia exports mostly raw materials, suggesting a huge potential for value creation

Sources: RBV’s analysis, UN Comtrade

To enhance the market value of agricultural products, the government can implement supportive policies and collaborate with the private sector to increase investments in food processing and technical skills development for Zambians, thereby promoting the production and export of finished products. This will create job opportunities and support the country’s eighth National Development Plan (NDP), which prioritizes economic diversification with a focus on agriculture.

What happens next?

In conclusion, the success of Zambia’s agricultural sector is crucial for the nation’s food security and poverty reduction efforts. By rethinking agriculture as an economic engine of growth, through appropriate policies, support, and capabilities, agriculture has the potential to transform and significantly impact people’s lives and the economy. No other sector has so much to offer.

At RBV, we believe that unlocking the full value of the Zambian agricultural sector requires a deeper understanding of its unique challenges and opportunities. By working with us, stakeholders in the agricultural value chain can access the latest data and insights, receive expert consultation and advice, and benefit from our innovative approach to problem-solving.

Sources

1. Habitat for Humanity GB. (2022, July 14). Housing poverty in Zambia.

2. African Union. (2016). The comprehensive African Agricultural Development Programme.

3. PMRC. (2021). The enabling business of agriculture towards a successful agricultural sector for Zambia.

4. Matchaya, G. C., Tadesse, G., & Kuteya, A. N. (2022). Rainfall shocks and crop productivity in Zambia: Implication for Agricultural Water Risk Management. Agricultural Water Management, 269, 107648. https://doi.org/10.1016/j.agwat.2022.107648.

5. IFAD. (n.d.). Smallholder Irrigation Revitalization Program.