Unlocking Zambia's Consumer Potential: How Young People, Urbanization, and Female Buyers will drive growth

Feature Image

March 07, 2023

As Red Black Ventures helps its clients navigate complex changes, it is clear that the growing consumer market is undergoing significant transformations. For instance, clients in our agricultural practice have observed a shift away from traditional maize products in favour of other options like pasta, noodles, and pastries. These demand-side changes yield significant disruptions to business models and their product portfolios. These shifts are also present on the supply side, with the payment space being a good example. Transactions by POS and Mobile Money grew from ZMW7.3Bn to ZMW169.4Bn between 2017 and 2021, representing a staggering compound annual growth rate of 120%. To stay competitive, businesses need to pivot carefully and respond to these rapidly evolving changes.

Our consumer analysis revealed that the changing consumer dynamics are partially driven by two factors: a shift in the overall demographic mix and evolving consumer preferences. In particular, our research shows that the future of the Zambian consumer is increasingly young, urban, and female. These shifts will drive notable growth in consumer spending levels and create business opportunities across different industries. The challenge is that current business models and infrastructure are not adequately prepared to serve these markets. This misalignment could have severe consequences for businesses that fail to adapt.

Currently, wholesale & retail trade is the largest GDP contributor by sector, accounting for 21% of Zambia’s gross domestic product. Given the current economic landscape, businesses now, more than ever, need adequate market research to understand how demographics are changing and where the opportunities for value and future growth lie. They also need to identify how to play in those markets and how to create new business models and infrastructure that can serve these evolving demographics. This proactive approach is critical to ensuring long-term success in the changing consumer landscape. As a starting point for businesses and individuals to plan their growth strategies, this article offers a glimpse into the future of the Zambian consumer and three potential demographics to consider.

1. Youthful Consumerism: The Future of Zambia's Consumer Market Will Be Driven by Young Demographics

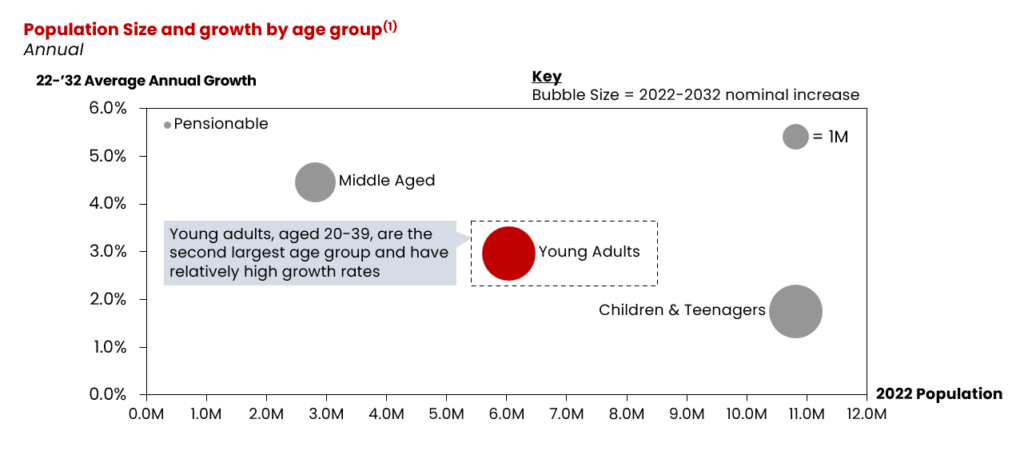

RBV's analysis shows that the Zambian consumer landscape is about to undergo a paradigm shift, primarily driven by the young population. In the coming years, young adults aged between 20-39 will solidify as a critical consumer segment in Zambia, with a projected growth of 2.1 million individuals over the next decade (Exhibit 1). This demographic group, currently consisting of six million individuals, will shape future consumer behaviour in the country through two crucial pathways: increased earning potential and a positive shift in attitude towards consumerism.

Exhibit 1: Young adults are growing at a fast rate and are the second-largest age group in Zambia.

Sources: RBV Analysis

(1) Pensionable = aged 65 and older, Middle aged = aged 40-64, Young Adults = aged 20-39, Children & Teenagers = Aged 19 and younger

Firstly, young adults will have increased earning potential owing to higher skill development levels and entrepreneurship uptake

Young adults have increased formal employment potential

As education and skills development gain increasing importance, the younger generation is becoming better equipped to contribute to the economy. In Zambia, both public and private universities have witnessed a steady increase in enrolment levels, which showed an average annual growth rate of 3.1% in the five years leading up to 2018 (latest available data). This education trend coupled with economic growth will translate into higher formal employment in the age group. Formal employment comes with higher wages, job security, access to credit and benefits such as health insurance, retirement plans, paid time off, etc, which will increase disposable incomes for young adults and drive consumer spending.

Entrepreneurship levels within the age group are increasing

In addition to the growing emphasis on education and skills development, the younger generation in Zambia is increasingly embracing entrepreneurship, challenging traditional notions of work and labour. Our studies show that compared to previous generations, Zambian young adults today are more inclined to start and manage their own businesses. The trend towards entrepreneurship among young adults in Zambia is driven by a combination of push and pull factors. Firstly, rising costs of higher education have made it more difficult for young people to find secure and well-paying jobs in the formal sector and therefore select into self-employment. On the other hand, recent policies have increased access to resources and support such as funding, mentorship, and training programs, making it easier for aspiring entrepreneurs to start and grow their own businesses. Increased entrepreneurship among young adults will lead to opportunities for higher earnings, job creation, innovation and competitiveness, and economic growth, which will result in higher disposable incomes and an uptick in consumption levels.

Secondly, young adults are experiencing a drastic but positive shift towards consumerism compared to previous generations

RBV has identified a transformative shift in consumer behaviour among young Zambians in the form of an increased willingness to spend on experiential goods and services. This contrasts with previous generations, who viewed consumption as a luxury or even a vice, and only engaged in activities such as travelling and eating out, on special occasions such as Christmas, Independence Day, etc. This shift is attributed to a combination of factors, including higher internet penetration rates, greater exposure to global trends through technology and social media, and even the emergence of Zambian influencers who are disrupting traditional consumption patterns. Zambian consumers now view consumption as a means of socializing, expressing identity and aspirations, and enhancing their quality of life. Notably, young adults are more optimistic about their economic prospects than previous generations, and their engagement in politics has made them a pivotal demographic in election cycles. As a consequence of their positive outlook, we note that young adults are more inclined to take on debt for purchases such as automobiles, thereby fuelling consumer spending.

The confluence of enhanced earning potential and evolving consumer behaviour among Zambia's youth will create opportunities for businesses in the fashion, entertainment and technology industries

RBV analysis forecasts an upsurge in market entry and growth prospects in the fashion, entertainment, and technology industries, fuelled by the distinctive behaviour of the youth segment. In the fashion sector, growth potential is expected to stem from the youth's pioneering role in setting fashion trends and influencing consumer demand. Young consumers' proclivity for early adoption of novel fashion products and trends will further fuel this growth. Similarly, in the entertainment industry, the high digital consumption habits of young adults will create demand for innovative content and lead to industry growth. Finally, the technology sector is poised to benefit from the youth's inclination towards new technological advancements, particularly as early adopters of disruptive technologies like smartphones, tablets, and wearable devices.

2. Urbanization Takes Over: The Future of Zambian Consumerism is Primed for Urban Growth

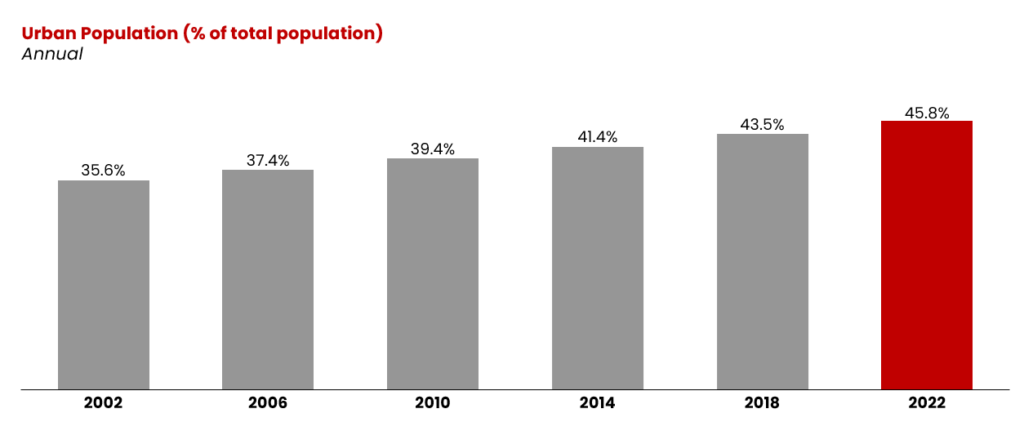

In our analysis, we observed a prominent trend of rapid urbanization, which has driven a substantial increase in the country’s urban population over the past 2 decades from 36% to 46% of the population (Exhibit 2). By 2030, the urban population is projected to surpass the rural population.

Exhibit 2: The urban population, expressed as a percentage of the total population increased by 10.1% over the last 2 decades

Sources: RBV Analysis

Population growth, economic development and rural-urban migration are the main drivers of the country's high urbanization rates

The Zambian population is expanding at an impressive average rate of 2.93% per year, nearly three times the global average of 1.04%, and is projected to double by 2050. We note that this population growth, propelled by high birth rates, is leading to a surge in the urban population. Economic advancement is another factor that is driving urban population growth. Despite the prevalence of contractionary conditions at the global level, the Zambian economy has demonstrated robust historical growth rates, even during recessionary periods. We anticipate that as the Zambian economy rebounds to pre-pandemic levels, growth in modern industries even in previously peri-urban or rural areas will increase, thereby increasing urbanization rates further. Finally, rural-urban migration is also on the rise as rural residents move to cities in pursuit of better job prospects and education opportunities. We expect this trend to continue going forward further driving the expansion of the urban population.

An increase in the urban population will create business opportunities in real estate, consumer electronics, transport and retail

The increasing urbanization trend will bring about a significant rise in demand for formal housing and commercial real estate as individuals experience income growth. This shift is expected to provide growth opportunities for businesses involved in real estate sub-industries such as real estate development, construction, and property management. Furthermore, we anticipate an uptick in demand for housing-related products and services such as furniture, appliances, and waste collection. The proliferation of urbanization will lead to a higher rate of technology adoption among individuals, resulting in an increased demand for consumer electronics such as laptops, tablets, and smartphones. The surge in urban population will also create opportunities for businesses involved in transportation and retail, as people in urban areas will demand more public transportation options and ride-sharing services, exemplified by the recent emergence of ride hailing services such as Yango and Ulendo. The higher population density in urban areas will also allow businesses involved in retail and e-commerce to capitalize on the growing customer base and expand their market presence.

3. Breaking Gender Barriers: The Future of Zambian Consumerism will be largely driven by women

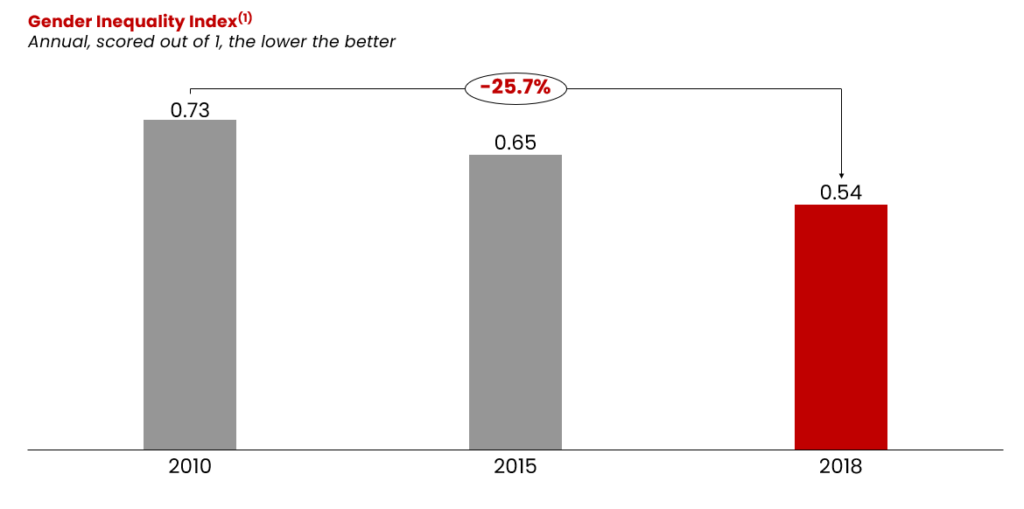

RBV's analysis suggests that the female consumer segment in Zambia will be a key sub-segment for future growth. Ongoing efforts by the government and NGOs to reduce the gender gap have yielded promising results, resulting in increased economic empowerment of Zambian women. The Gender Inequality Index, in the period from 2010 to 2018, experienced a decrease from 0.72 to 0.54, indicating improved access to education, higher labour force participation rates, and better leadership opportunities for women (Exhibit 3). These positive trends will likely result in a radical change to the consumer spending landscape in Zambia, owing to higher earning potential and increased spending levels among female consumers.

Exhibit 3: Equality between the male and female gender, as measured by the gender inequality index, has improved by 26.7% between 2010 and 2018.

Sources: RBV Analysis

(1) The Gender Inequality Index, abbreviated GII is a composite measure of inequality using three dimensions: reproductive health, empowerment, and the labour market. A low GII indicates low inequality between women and men and vice versa.

We expect to see an increase in disposable incomes for the female population

As the gender gap narrows, there will be a commensurate increase in access to education for women, facilitated by targeted policies, scholarships, and initiatives that foster female academic achievement. Such initiatives are creating an environment that enables and supports increased female labour force participation. This shift in the labour market will, in turn, result in improved income levels for the female population.

Our analysis also indicates a significant increase in female participation in entrepreneurship, driven by more supportive policies and networks, as well as evolving cultural attitudes. As more women start, own, and grow their businesses, we see a higher ability to generate income for themselves which in turn, will increase disposable incomes and further fuel growth in consumer spending.

Women in Zambia are also gaining better access to credit opportunities, exemplified by the success of informal credit facilities such as the Village Banking Scheme. These informal credit facilities, often provided by community-based individuals or small organizations, are bridging the gap for underserved populations who face challenges in accessing formal banking services due to collateral limitations, credit history constraints, and other entry barriers. The Village Banking Scheme has been instrumental in increasing women's participation rates in informal credit and savings initiatives, which were 29% higher than for their male counterparts in 2020 (latest available data). Improved access to credit and financial services has enabled women to start and expand small businesses, resulting in increased incomes for themselves and others through job creation.

Food & beverage, beauty & personal care, and health & wellness are some of the industries that will benefit from a growing female footprint in the consumer landscape

As per the World Bank Gender Status report, Zambian women have emerged as pivotal decision-makers in household expenditures, with responsibility for buying groceries, household utilities, and even overseeing housing budgets (Exhibit 4). Of note, spending on food and non-alcoholic beverage represents the largest expenditure category, accounting for 30% of total spending, highlighting the immense potential within the female segment.

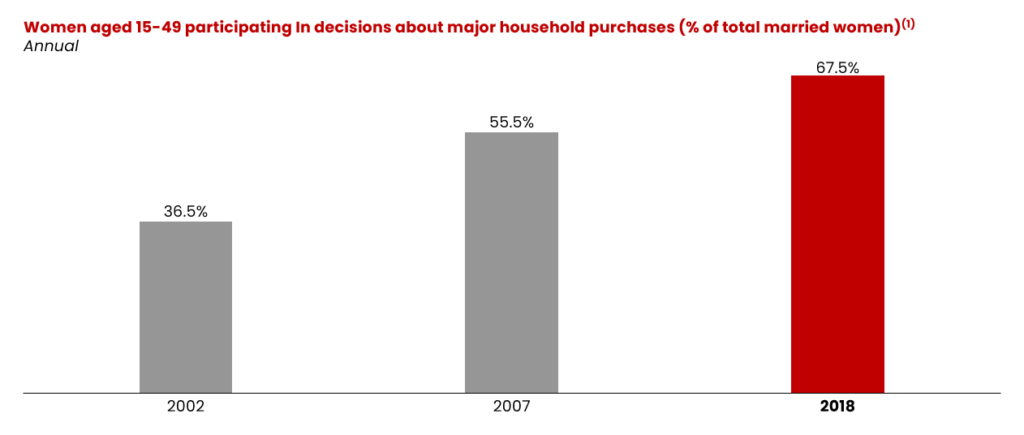

Exhibit 4: The percentage of women participating in decisions about major household purchases increased to 67.5% in 2018.