Unlocking Zambia’s Tourism Potential: 4 Steps to US$ 2 Billion Revenue by 2030

Featured Image

January 16. 2024

Brief Overview

Zambia’s tourism potential is immense, given its abundant resources

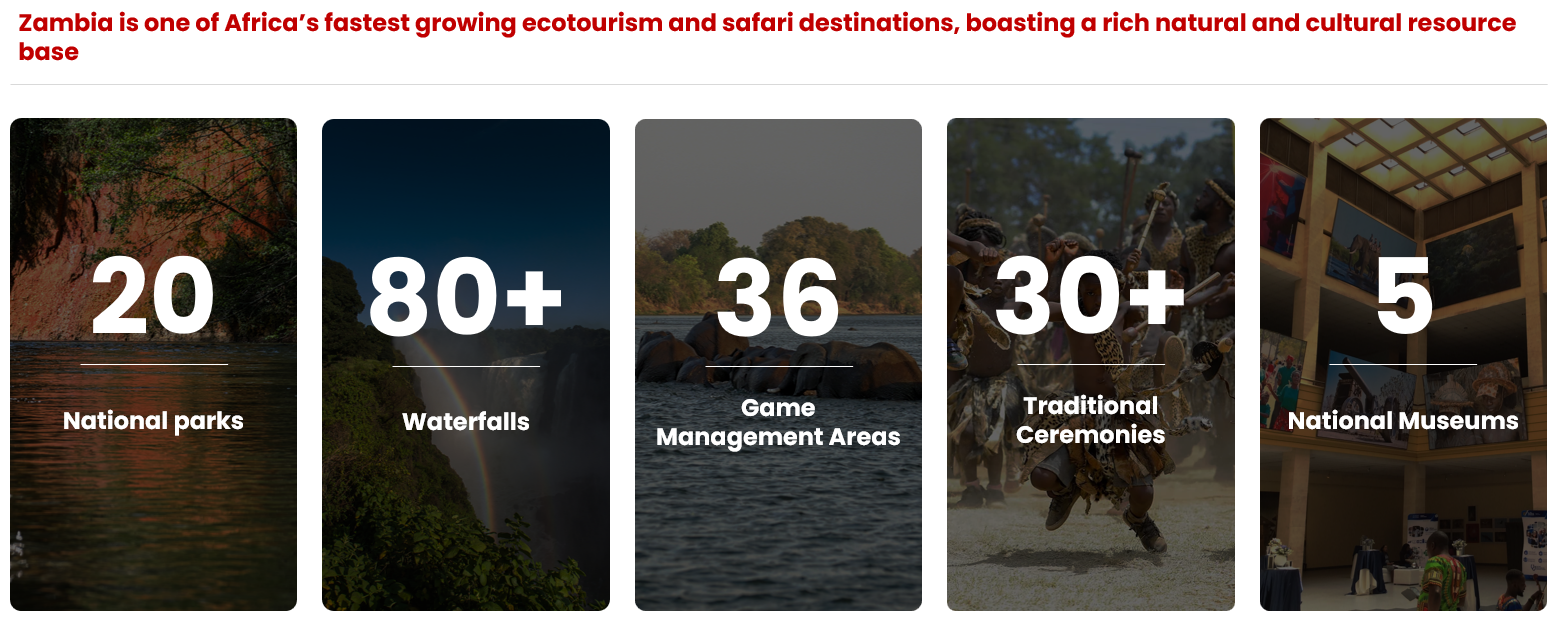

Zambia has extraordinary tourism potential, driven by its abundant and diverse resources. At the forefront of its attractions is the awe-inspiring Victoria Falls, a globally renowned UNESCO World Heritage Site, and a true marvel of nature. Beyond this attraction, Zambia offers travelers a wide range of ecotourism and safari opportunities. With over 80 additional waterfalls, 20 national parks, 36 game management areas, 5 national museums, and more than 30 traditional ceremonies steeped in rich heritage and culture, Zambia’s tourism offerings form a compelling portfolio (Exhibit 1). This positions Zambia for sustained and strategic growth in the tourism sector.

Exhibit 1: Zambia is well endowed with an array of natural landscapes, extensive water bodies, diverse wildlife, and a rich cultural heritage

Sources: Domestic Tourism Development Strategy, Tourism Statistical Digest, Fitch, Discover Zambia, Red Black Ventures

Zambia’s central location and its investor-friendly environment make it an ideal tourism hub

Zambia’s strategic central location at the crossroads of Southern and Central Africa, bordered by eight diverse markets, positions it as an ideal hub for regional and international tourism. This geography offers seamless access to a wide array of tourist attractions, making Zambia an appealing prospect for investors in the tourism sector. Further, Zambia actively demonstrates its dedication to promoting investment in the tourism sector by establishing a favorable economic climate. The country offers a range of incentives to support sectoral expansion, including a zero Value Added Tax (VAT) rate on tourist services for international visitors. Additionally, non-resident tourists are eligible for VAT refunds on specific goods, and there is a waiver on import VAT for goods temporarily brought into the country by foreign tourists.

Despite having significant potential, Zambia's tourism sector has yet to fully capitalize on its opportunities

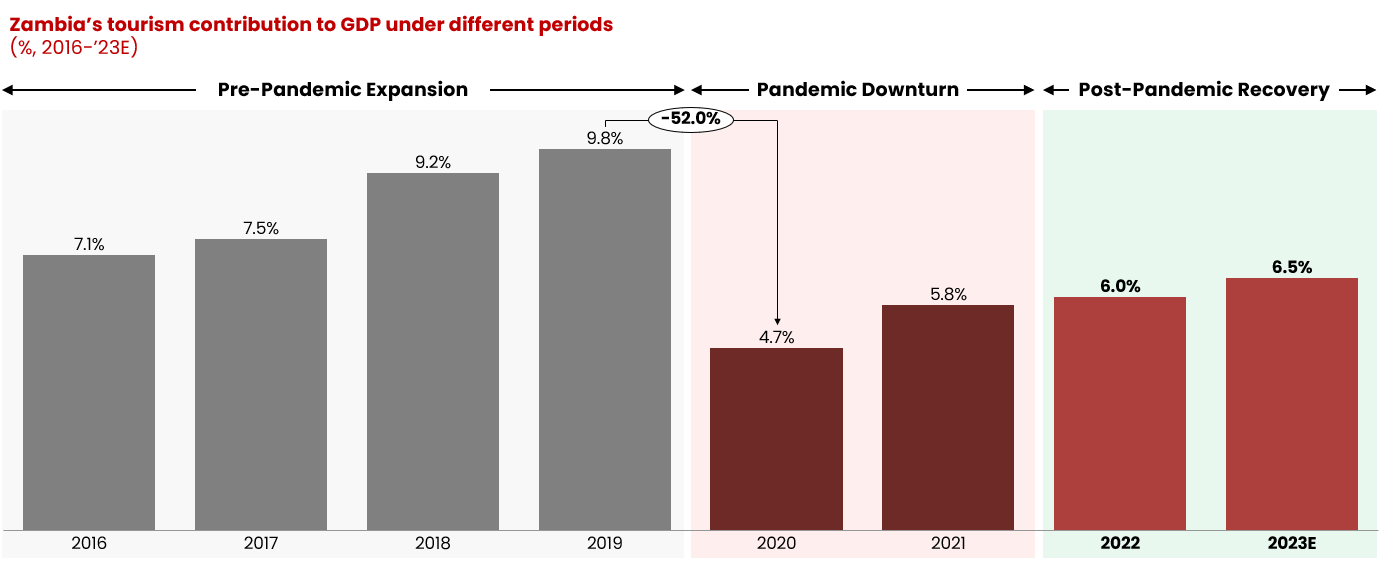

Zambia’s tourism sector has been on an upward trajectory for some time now, making great strides towards its development. However, despite this progress, the sector still faces significant challenges that have hindered its growth. For example, the Covid-19 pandemic dealt a severe blow to this growth, causing a sharp decline in the industry. The sector’s contribution to Gross Domestic Product (GDP) plummeted by 52% at the onset of the pandemic. Though it has made a marginal increase of approximately 1.8% over the past three years, it is still far from its pre-pandemic levels (Exhibit 2).

Exhibit 2: Many unforeseen circumstances, including the pandemic, have affected Zambia's tourism sector, hampering its growth

Sources: Fitch, Red Black Ventures

In the wake of the global pandemic, international travel is gradually rebounding, although growth remains modest. There is potential to speed up the recovery process and bolster the sector’s contribution to GDP by increasing the number of international arrivals.

To foster growth and investment in the tourism industry, a collaborative effort from all stakeholders is crucial. The government, private sector, and civil society need to work together in formulating and executing strategies that can breathe new life into the tourism sector. This not only has the potential to boost the country’s GDP but also to generate employment opportunities, especially for the youth, who constitute a significant portion of the population. In this article, we present our insights on how Zambia can harness the full potential of its tourism sector and facilitate its development.

RBV’s Perspective

Implementing four growth strategies will be crucial in unlocking Zambia’s tourism potential

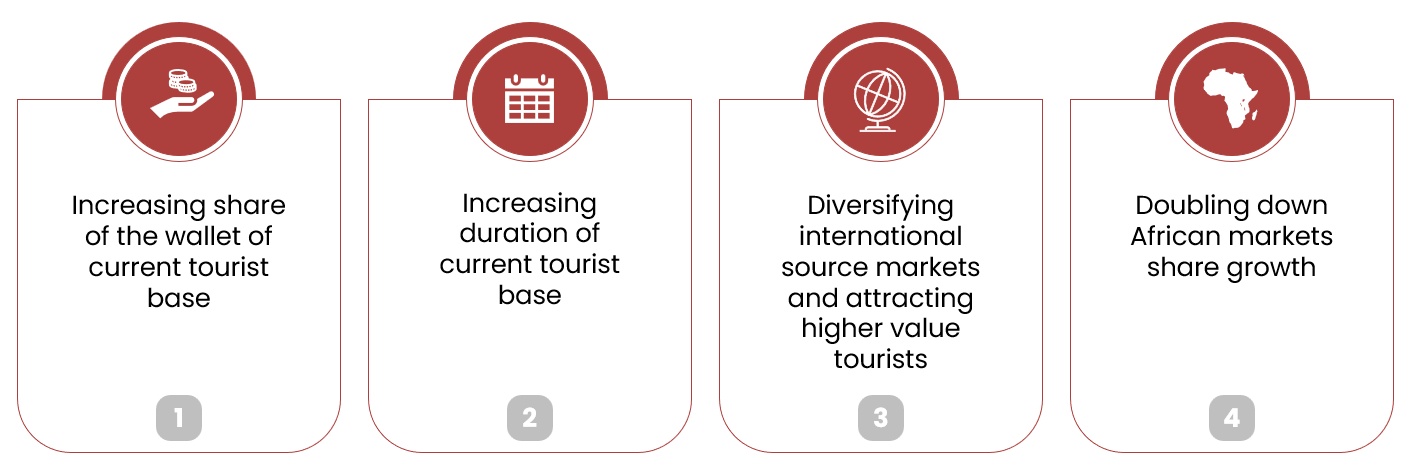

In a comprehensive analysis of Zambia’s tourism sector, we have pinpointed four strategic growth opportunities. These key recommendations are rooted in a nuanced understanding of demand-side dynamics. They include increasing share of the wallet of the current tourist base, increasing duration of stay of the current tourist base, diversifying international source markets, and doubling down on Zambia’s regional market share (Exhibit 3).

Exhibit 3: Zambia can significantly increase tourism revenue by focusing on 4 critical growth strategies

Sources: Red Black Ventures

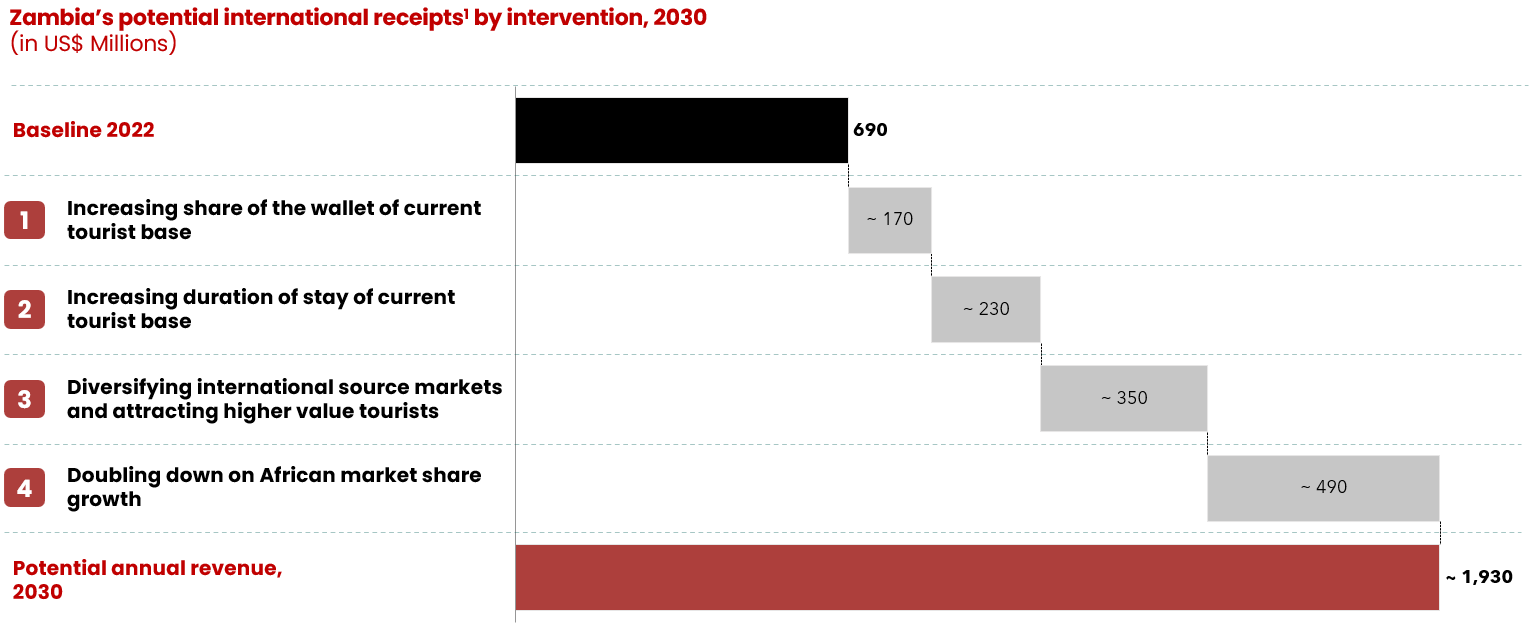

By consolidating existing market positions and exploring untapped markets, the sector’s value could triple by 2030. This projection vividly illustrates the potential that lies within Zambia’s tourism industry. If the country can capitalize on this potential, we could see revenue surge from around US$ 700 million in 2022 to approximately US$2 billion by 2030 (Exhibit 4). This kind of growth would undoubtedly have a significant impact on the country’s economy and the lives of the people who call it home.

Exhibit 4: We believe that these 4 factors have the potential to triple the sector's revenues by 2030*

Sources: Fitch, Ministry of Tourism (Zambia), Red Black Ventures

*In determining the impact of the interventions, we analyzed the performance of comparable benchmarks and projected performance after the pandemic.

In the paragraphs that follow, we provide detailed insights into each growth strategy, highlighting the approaches adopted by prosperous nations.

1. Increasing share of the wallet of the current tourist base

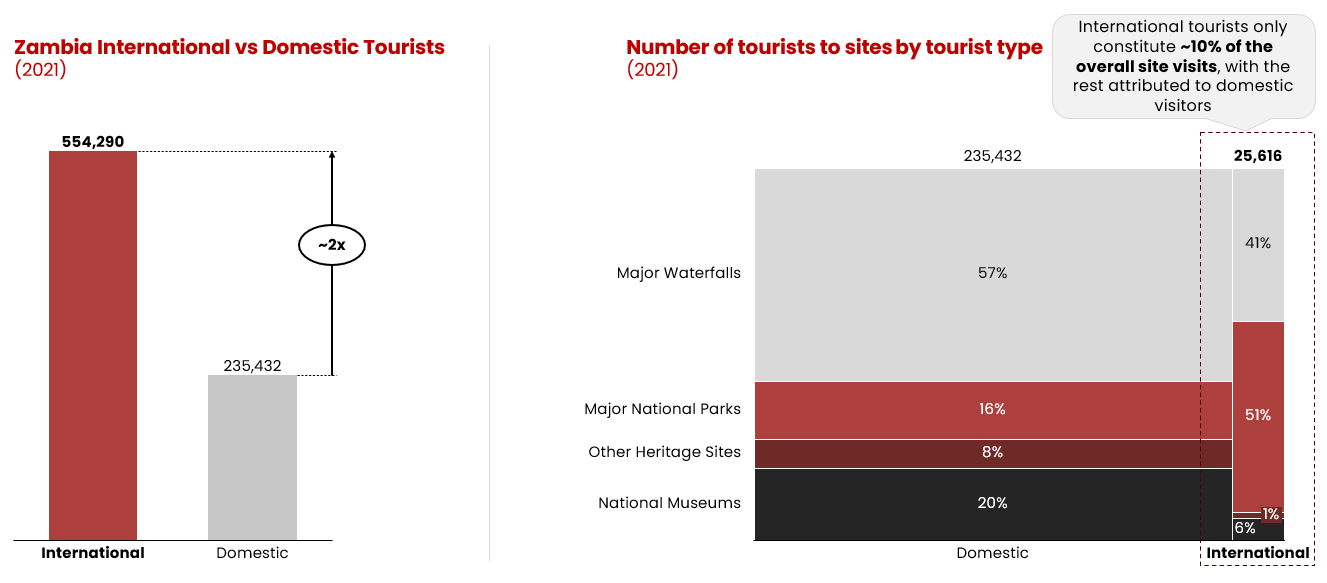

Despite a notable surge in international tourist arrivals post the Covid-19 pandemic, engagement in site visits remains disproportionately low, with the majority being undertaken by domestic tourists (Exhibit 5). Even though international arrivals significantly surpass domestic numbers, their participation rate in site visits is low, constituting only about 10% of the overall site visits, leading to a subdued average spend per visit. This underscores a considerable opportunity to boost the share of the wallet from existing tourist arrivals by fostering increased engagement in site visits.

Exhibit 5: In 2021, international tourists were nearly double the number of domestic tourists, but most of the visits to Zambia's main tourist sites are domestic*

Sources: Fitch, Ministry of Tourism (Zambia), Red Black Ventures

*The following sites were explored in this analysis: waterfalls (Nyambwezu, Mutanda, Kundalila, Chilambwe, Chipoma, Chishimba, Kalambo, Lufubu, Lumangwe, Mumbuluma, Ntumbachushi, Victoria and Kundabwika Falls), national parks (Mosi-Oa-Tunya, Lower Zambezi, South Luangwa, Kafue, and Lusaka National Parks), other heritage sites (Dag Hammarskjold, Kifubwa, Lake Kashiba, Zambezi Source, Chilenje House, Chinyunyu Hotspring, Ingombe Ilede, Mwela Rock, Nachikufu Cave, Von Lettow Vorbeck, Railway Museum, Presidential Burial Site) and national museums (Choma, Copperbelt, Livingstone, Lusaka, and Moto Moto National Museums)

To encourage more site visits, some of the key approaches we have observed from leading nations include:

- Designing targeted promotions and discounts for specific tourist sites, incentivizing visitors to explore these attractions with exclusive deals and packages

- Developing detailed and interactive digital maps that provide information about each tourist site, making it easier for visitors to plan and navigate their visits accordingly

- Organizing special events, performances, or cultural activities at specific sites, providing additional attractions, and drawing visitors to explore those locations

- Improving the road infrastructure leading to the sites to enhance access and encourage more visitors to explore specific tourist sites

2. Increasing the duration of stay of the current tourist base

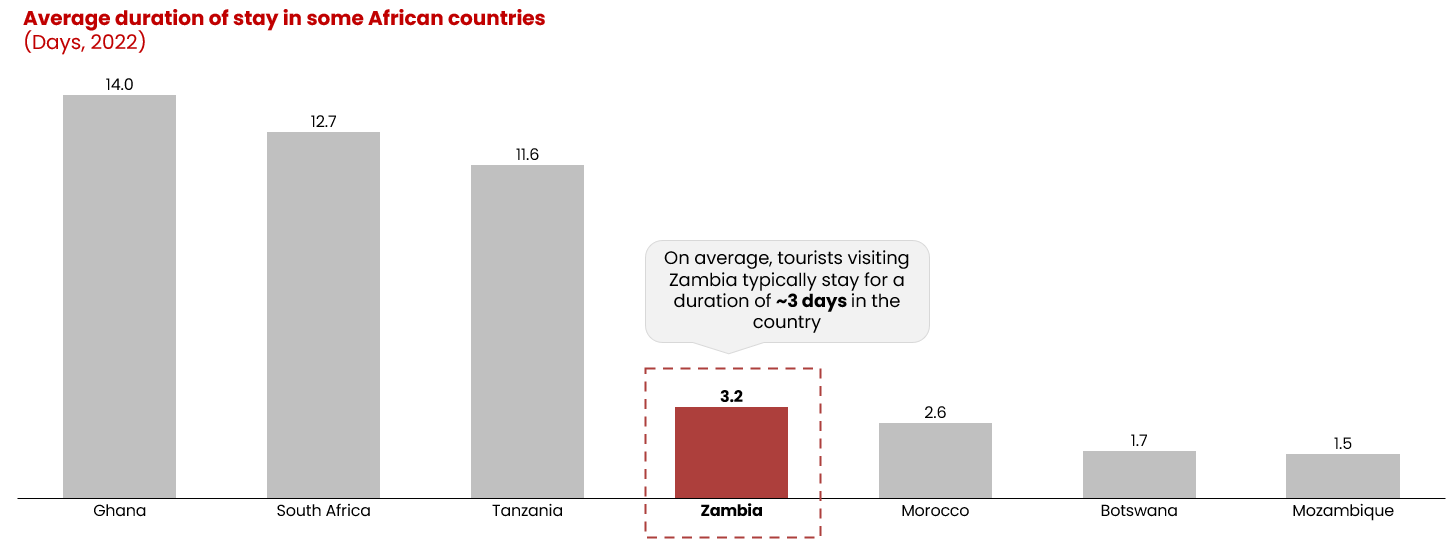

Our analysis has brought to light that Zambia falls behind several regional counterparts in terms of the average duration of stay for international tourists (Exhibit 6). International tourists in Zambia typically stay for an average of 3 days, a duration significantly shorter than that observed in key competitors such as South Africa and Tanzania, where tourists stay for around 12 days each. Several factors contribute to the shorter stay duration, including the perception of Zambia as an expensive destination for tourists, limited diversification of tourism offerings, the view of Zambia as an ‘add-on’ or connecting destination for leisure travelers, and the prevalence of shorter business trips for most visitors, among other reasons.

The shorter duration of tourist stays in Zambia directly translates into lower gross receipts per tourist trip. Consequently, addressing these concerns becomes pivotal in bolstering Zambia’s tourism revenue and fortifying its competitiveness in the region.

Exhibit 6: Tourists in Zambia tend to have a shorter length of stay compared to peers in the region

Sources: Fitch, Ministry of Tourism (Zambia), Red Black Ventures

To extend the duration of tourists’ stays, prominent tourism nations worldwide have adopted several initiatives, such as:

- Introducing a wider array of tourism products and experiences to cater to diverse interests and preferences, ensuring something compelling for every type of traveler

- Investing in infrastructure development, including transportation and accommodation, to enhance accessibility and convenience

- Emphasizing and promoting Zambia’s unique cultural and ecological assets, encouraging visitors to explore the rich cultural heritage and natural beauty the country has to offer

- Launching targeted campaigns to change perceptions and showcase Zambia as a destination with a wide range of attractions, dispelling the notion that it is only a connecting point or secondary destination

- Establishing mechanisms for continuous feedback from visitors to understand their needs and preferences, allowing for the adaptation of strategies in real time

- Prioritizing the enhancement of hospitality services, ensuring that tourists receive high quality service and memorable experiences that encourage them to extend their stay

3. Diversifying international source markets and attracting higher value tourists

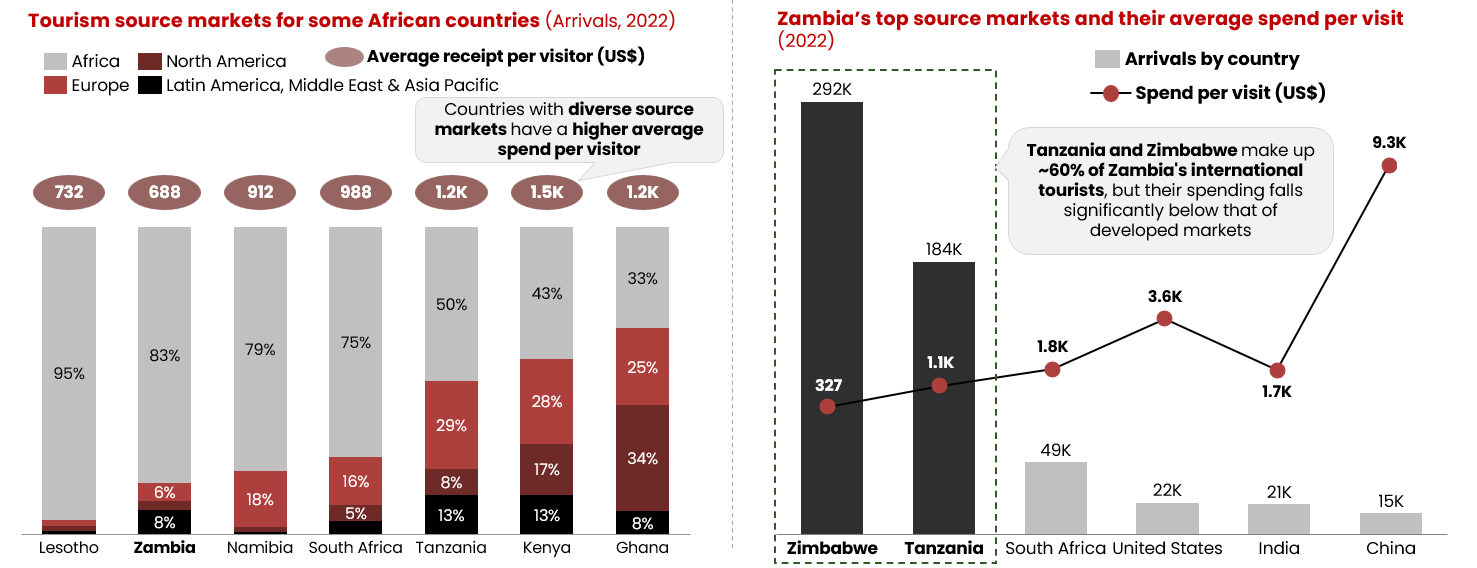

There is an imperative need to address the current imbalance in Zambia’s tourism source markets. Presently, approximately 60% of Zambia’s international tourists originate from Zimbabwe and Tanzania (Exhibit 7). While we acknowledge the positive impact of attracting a substantial number of international tourists from these countries, it is crucial to recognize the industry challenge associated with this trend. The concern arises, as tourists from these countries generally demonstrate a comparatively lower spending capacity per visitor than those from affluent source markets.

This observation does not diminish the value of regional visitors but emphasizes the potential for increased economic returns through diversifying source markets to include countries with higher spending capacities, such as China, the United States of America (USA), the United Arab Emirates (UAE), and others. Our research reveals that nations with a more diversified tourism source market tend to achieve higher average receipts per visitor.

Exhibit 7: In general, countries with more diverse tourism source markets tend to earn more receipts, but Zambia’s source market is primarily regional, mostly Tanzania and Zimbabwe, with less affluent tourists

Sources: Fitch, Ministry of Tourism (Zambia), Statista, Red Black Ventures

Diversifying international source markets and attracting tourists from high-spending markets is key to boosting revenue within the sector. Leading nations globally have achieved this through:

- Developing a targeted strategy to diversify the sources of international tourists by actively promoting Zambia in markets with higher potential for tourism expenditure, such as China, USA, UAE, etc.

- Tailoring tourism products and experiences to cater to the preferences and interests of potential visitors from high-spending countries, ensuring a compelling portfolio

- Forging strategic partnerships with travel agencies, tour operators, and international stakeholders to amplify the reach of Zambia’s tourism promotion

- Elevating the quality of services and amenities to meet the expectations of visitors from high-spending markets, thereby enhancing the overall experience

- Leveraging data analytics to identify and understand trends in the travel preferences of high-spending tourists, enabling informed decision making in targeting specific markets

4. Doubling down on regional market share growth

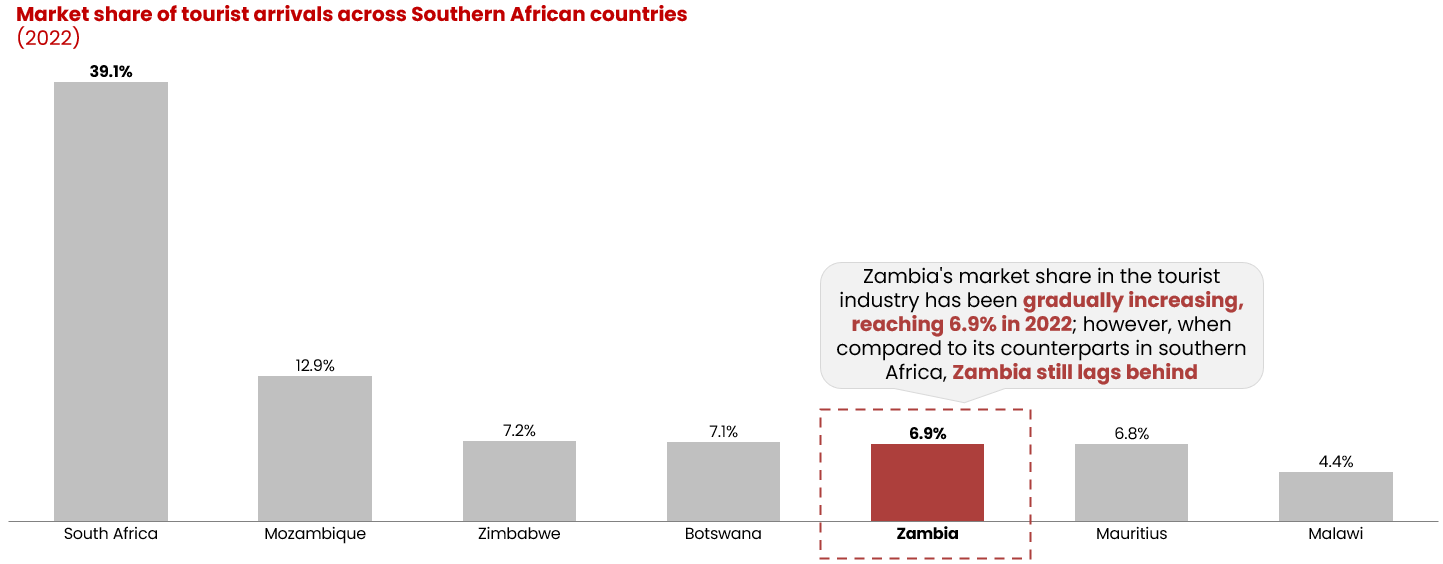

Additionally, the nation could intensify efforts to increase its regional market share. Presently, Zambia’s share of international tourist arrivals in Southern Africa stands at only 6% (Exhibit 8), a considerably lower figure compared to South Africa and Mozambique, which boast shares of 39% and 13%, respectively. This underscores the urgent need for substantial growth within the region.

Exhibit 8: Zambia holds a relatively smaller share of international tourist market compared to counterparts in the region, standing at 6% in 2022

Sources: Fitch, Red Black Ventures

Therefore, to increase Zambia’s regional market share, the nation could:

- Encourage and champion sustainable tourism practices, recognizing the growing preference among global travelers for destinations that actively uphold environmental conservation and responsible tourism, particularly in the realm of ecotourism

- Collaborate with international airlines to improve connectivity and promote direct flights, making it easier for tourists to reach Zambia from different parts of the world

- Enhance global online visibility through the implementation of a robust digital marketing strategy designed to target international markets

What happens next?

In summary, the tourism industry in Zambia plays an essential role in the country’s economy. Therefore, it is crucial to adopt a targeted and strategic approach to ensure its growth and sustainability. In this article, we have highlighted four demand-driven initiatives, including increasing the share of the wallet from the existing tourist base, prolonging the duration of stay for current tourists, diversifying international source markets and attracting high-value tourists, and intensifying efforts to expand market share within Africa. These initiatives offer a clear roadmap to infuse substantial value into the tourism sector. Their implementation can empower Zambia to leverage its rich natural and cultural resources, creating a tourism landscape that not only attracts visitors but also yields significant economic returns. This, in turn, would make a substantial contribution to the overall prosperity of the nation.

It is worth noting, however, that while our article focuses on demand-side initiatives, there are still viable opportunities on the supply side. Nevertheless, prioritizing demand-side strategies in the short term is more effective for several reasons. For instance, supply-side initiatives, such as infrastructure development and an increase in tourism product offerings, are typically time-consuming and may require several years to accomplish. The benefits of implementing such projects and other supply-side improvements to increase revenue returns in the tourism sector might not be immediately realized. Additionally, these supply-side initiatives often require substantial financial resources to implement, posing significant challenges for countries like Zambia with budget constraints and potentially impacting the near-term economic outlook.

At RBV, we believe that unlocking the full value of the Zambian tourism sector requires a deeper understanding of its unique challenges and opportunities. By working collaboratively with us, stakeholders in the tourism value chain can access the latest data and insights, receive expert consultation and advice, and benefit from our innovative approach to problem-solving.

Sources

- Ministry of Tourism Zambia. 2021. 2017-2021 Statistical Digest Reports. MOT.

- Ministry of Tourism Zambia. 2022. Zambia 2022 Tourism Investment Guide. MOT

- Ministry of Tourism Zambia. 2017. Zambia Tourism Master Plan 2018-2038. MOT

- Ministry of Tourism Zambia. 2022. Domestic Tourism Development Strategy 2022-2026. MOT

- Fitch Solutions. 2023. Interactive Portal. Accessed on 16th September 2023

- Discover Zambia. 2023. Nc’wala Ceremony. Accessed on 16th September 2023